Header Bidding: what is it and how does it work?

If there is a “word of the moment” in Programmatic Advertising, that word is Header Bidding. Behind this difficult term, there is a technology to buy and sell digital inventory through bids. A technology that could be extremely useful both for advertisers and for publishers.

Let’s take a look at how Header Bidding works and why it is so important.

We can describe Header Bidding as a Programmatic technique that allows publishers to offer their inventory to multiple ad exchanges simultaneously. But to understand what that means, it is probably better to take a step back, and look at how RTB Programmatic trading traditionally operates; that is, through the so-called “waterfall model.”

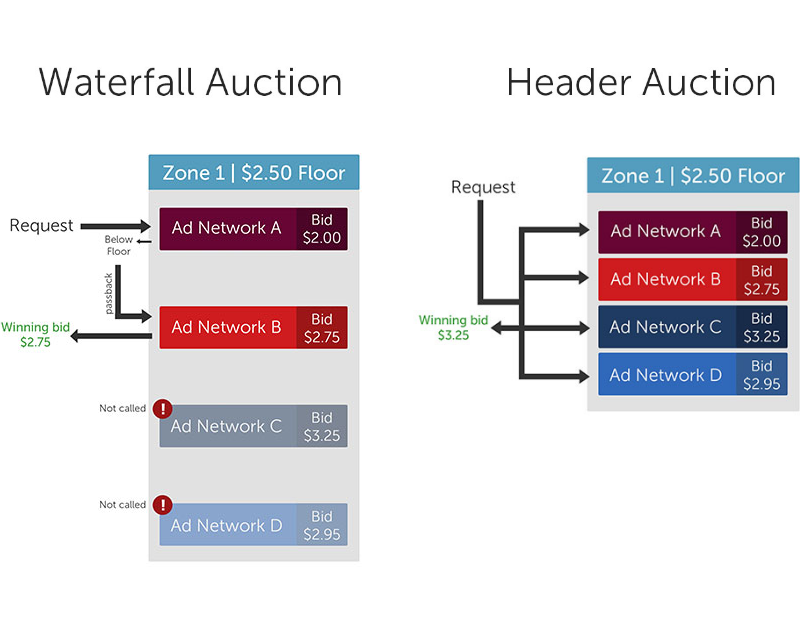

In the waterfall model, demand sources place their offers sequentially. If the inventory has not been sold directly, it is auctioned at a given floor price (or minimum price), and ad exchanges take part in the bid one by one. If the first bidder offers a higher amount than the floor price, it will obtain the inventory; otherwise, the process will continue with the second one. And so on, until the inventory is sold. Every time a request does not succeed, the impression goes back to the publisher’s ad server, through a mechanism called “passback”, which slows down the whole process.

To make things clearer, let’s consider an example. A website has four preferred ad networks to sell its inventory. When a user opens a page of that website, the ad server “calls” the ad networks, defining a floor price of, let’s say, $2.50. The first ad network offers $2.00, and the impression returns to the ad server (passback) since this amount is lower than the floor price. Then the process continues with the second ad network, which offers $2.75 and wins the auction. The publisher will never know that the third would have offered $3.25, and the fourth $2.95.

As you can see, this model has obvious disadvantages. First of all, demand sources at the bottom of the waterfall can rarely have access to the inventory. Furthermore, publishers have to settle for the first CPM (Cost per Thousand Impression) that is higher than floor price, excluding potentially more advantageous deals a priori.

Now let’s go back to Header Bidding. Thanks to this technology, buying requests occur in parallel; demand sources compete without priorities. Technically, by means of a few lines of JavaScript code on the website header (hence the name Header Bidding), the publisher “opens” the inventory to the participants of the auction, and they can bid for the impression all at the same time. The publisher can then select the best one among the offers it has received.

Considering our previous example, now that the publisher can see all the CPMs simultaneously, it will choose the highest one, that is the third.

At this point, you may have already guessed how Header Bidding can be useful both for advertisers and for publishers. On the demand side, all the platforms have the possibility to access to premium inventory, while with the waterfall model some of them could only compete for unsold impressions. On the sell side, publishers are able to maximize their supply value; for instance, some of the bidders may be willing to offer a lot of money for inventory particularly relevant to their targets. Additionally, since all the bidders participate in the auction at the same time, there is more competition in the process and the average CPM increases. Furthermore, using Header Bidding, publishers can have a better sense of the real economic value of their inventory. And that can be useful to define the floor prices for the bids, and therefore to have more control over the inventory. Last but not least, the use of Header Bidding technology significantly reduces the number of passbacks, leading to a faster trading process.