Google Exchange Bidding Dynamic Allocation (EBDA): what it is and how it works

Many publishers struggle to understand what Google Exchange Bidding Dynamic Allocation (EBDA) is and how it works, and very often they confuse it with header bidding. In this post, we will explain the mechanisms behind this technology and how publishers can use it.

The most common definition of Exchange Bidding Dynamic Allocation (EBDA) is “Google’s alternative to header bidding”. And that’s indeed what it is. To understand why, though, we have to look at how inventories were sold a few years ago before this solution was created.

Until 2016, Google’s ad exchange AdX had clear advantages over any other exchange and SSP in auctions run on DoubleClick for Publishers (DFP), which is Google’s ad server. AdX could compete with the publisher’s direct sales team before any other platform had access to the auction. Therefore, while AdX could run for premium inventory, all the other ad exchanges and SSPs could only compete for unsold ad units.

The frustration of all these other platforms and their need for a fairer model led to the introduction of header bidding in 2016, which was a great success. This technology allowed multiple ad exchanges – not just AdX – to participate simultaneously in a single auction, thus increasing the competition among platforms and, therefore, the publisher’s revenue.

The huge success and widespread adoption of header bidding among media owners motivated Google to create its own alternative to this technology: Exchange Bidding Dynamic Allocation (EBDA).

Summary

- What is Exchange Bidding Dynamic Allocation (EBDA)?

- How does Exchange Bidding Dynamic Allocation (EBDA) work?

What is Exchange Bidding Dynamic Allocation (EBDA)?

Technically, Exchange Bidding Dynamic Allocation (EBDA) is a server-side solution that gives ad exchanges and SSPs the ability to bid on publisher inventory along with Google AdX in a unified auction. It may sound the same as header bidding, but it’s not.

Google itself explains, in its support page, that: “Exchange Bidding Dynamic Allocation (EBDA) lets the DFP ad server communicate directly with third-party ad exchanges in a server-to-server connection, rather than communicating through custom header bidding code implemented in a publisher’s mobile app or webpage”. This means that differently from header bidding in which the auction takes place in the site or app header, with Exchange Bidding Dynamic Allocation (EBDA) the auction runs on the ad server. This reduces page load latency and, moreover, eliminates any complex publisher configuration required by header bidding.

How does Exchange Bidding Dynamic Allocation (EBDA) work?

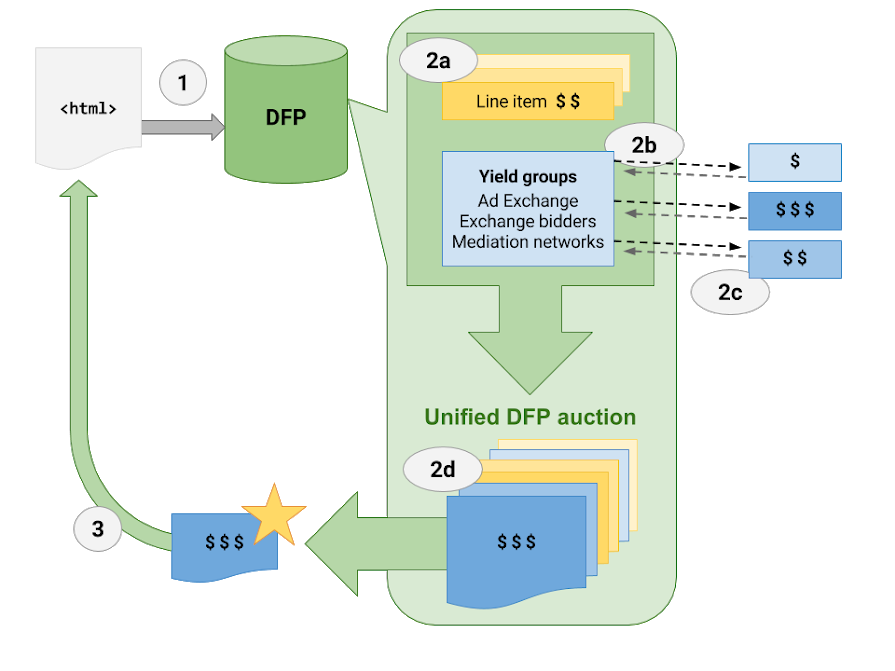

Now let’s take a look at how Exchange Bidding Dynamic Allocation (EBDA) works. The entire process begins when an ad request is triggered, for example when a user opens a web page that contains advertising spaces. All the data regarding the ad unit to be sold, such as information about the user, device and targeting, is passed to DoubleClick for Publishers, which sends a bid request to all the eligible ad exchanges – also called “yield partners”. Yield partners are organized in groups composed by different platforms, including AdX. Each group conducts an internal auction, and all the winning bids are sent back to DFP, which runs a unified auction to determine the best yield for the ad unit. Here you can find an infographic with additional details on the entire process.

- An ad request is triggered and information is passed to the DFP ad server

- DFP runs a unified auction to determine the best yield

2a. DFP selects the best trafficked line item to compete in the unified auction

2b. DFP sends a bid request to targeted yield partners

2c. Targeted yield partners run their own auction and returns their most competitive bid to DFP

2d. DFP hosts a unified auction and selects a winner

- A creative or Mediation list is returned to the publisher

It’s important to notice that, in this process, AdX doesn’t have any priority over the competitors, but places its bid along with all the other platforms, at the same time and in the same way.

Exchange Bidding Dynamic Allocation (EBDA) is officially available since April 2018. Today it can be used by publishers all over the world for selling their Web (desktop and mobile) and In-App (iOS, Android and Interstitial) inventory. Currently, it’s not yet available for Native and In-Stream Video ad units.