Google shifts to first price auction. What it means for price optimization

The advertising industry has been experimenting with the first price auction model for a couple of years now, but the pace of change has been relatively slow. Today, the majority of inventory is still traded in second price auctions. All this is about to change later in 2019, as Google announced plans to transition 100% of its Ad Manager and Ad Exchange auctions to first price this year.

In this post we will give a quick overview of auction mechanics, and talk about the impact this change could have on inventory price optimization.

Summary

- What is driving the change from second price to first price?

- What does transition to first price mean for price floor optimization?

What is driving the change from second price to first price?

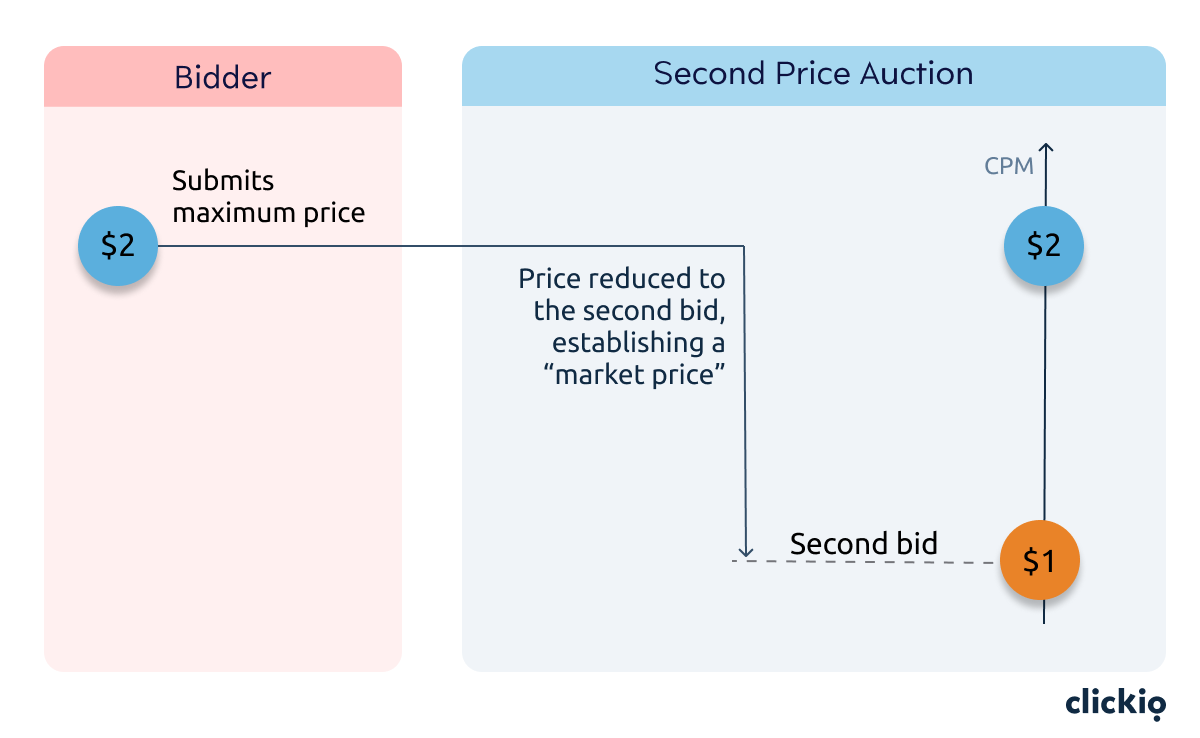

Second price auction

In the early days of programmatic advertising, a single auction would be used to sell an ad impression. The second price model is well suited for this scenario. Because the winner’s bid is reduced to the second highest bid, advertisers can submit their “maximum possible price”, or “true value” of the impression, and trust that the auction will bring this price down to a fair market price. This simplifies live for buyers while protecting their profit margins.

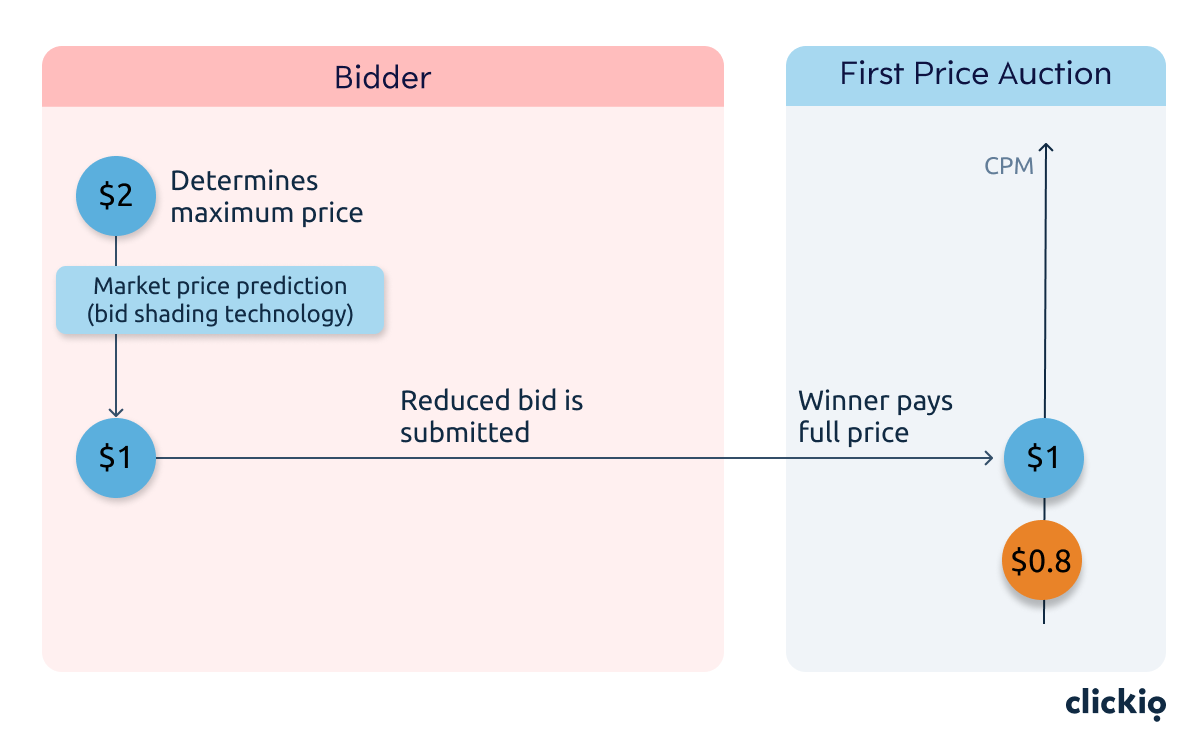

First price auction

Compare it to a first price auction. The highest bid wins, and the winner pays the exactly bid price. The auction is simpler, but the buyers can no longer submit their “true maximum price”, as their profit margins would disappear. Instead, they need to predict what the market price for an impression is. This prediction involves collecting historic data on bids and win rates for very granular inventory segments (sites, ad units, devices and such). While the auction is simpler, the buyers technology becomes significantly more complex.

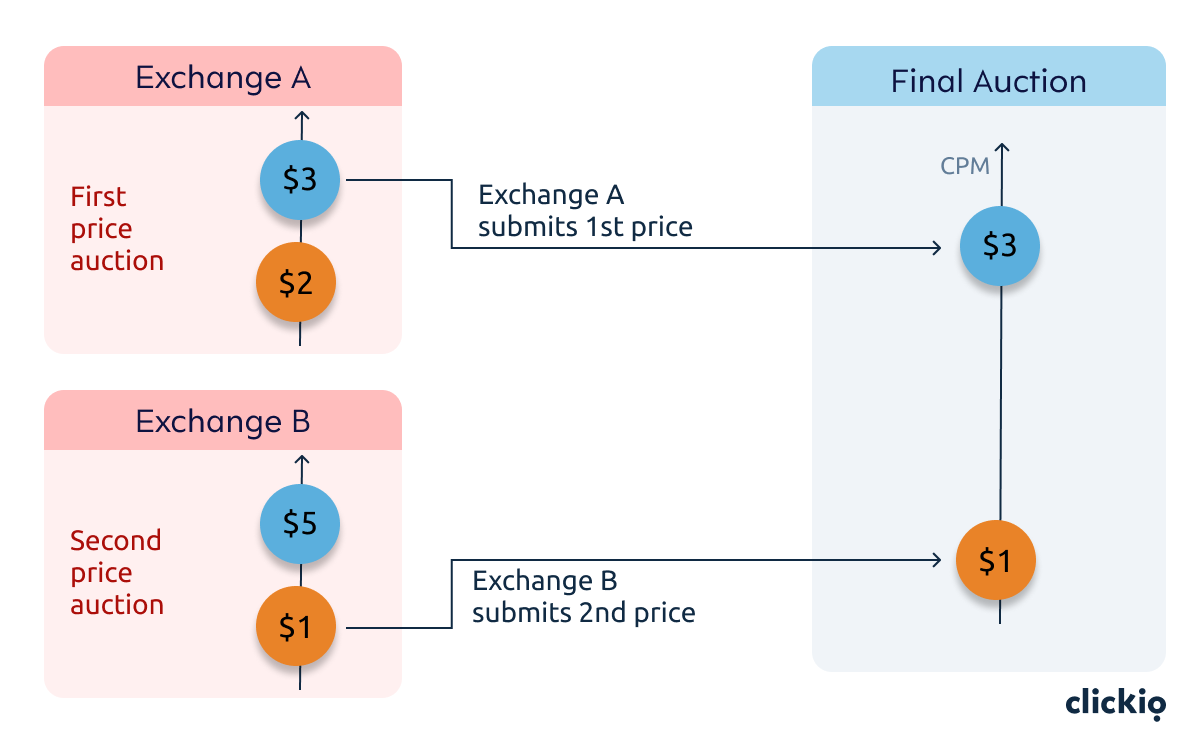

Multi-auction

As the ecosystem developed, different exchanges started to compete for the same impressions in real-time, either using header bidding, exchange bidding, or similar mechanics. A single ad call could pass through multiple auction before the winner is determined.

As you can see on the diagram, multiple auctions with mixed rules quickly become rather confusing. Exchange B has a higher bid, but loses out to Exchange A.

Effects like this could incentivize exchanges to switch to the first price model. In fact, many exchanges, such as OpenX, Rubicon Project and Index Exchange, started introducing first price auctions back in 2017.

Google Ad Manager switches to first price

Google announced its plan to simplify the auction dynamics in the industry by moving Ad Manager and Ad Exchange to first price.

“This complexity has made it difficult for advertisers and agencies to properly value programmatic inventory”, Sam Cox, Group Product Manager, wrote in the official blog post. “Further, the increasing intricacy of programmatic has made it operationally very difficult, even for experts, to determine what’s going well and what needs to be improved.”

The switch will begin in the next few months, and should be 100% completed by the end of the year.

What does transition to first price mean for price floor optimization?

If done correctly, adjusting price floors in Ad Exchange can have a significant positive impact on publisher’s revenues.

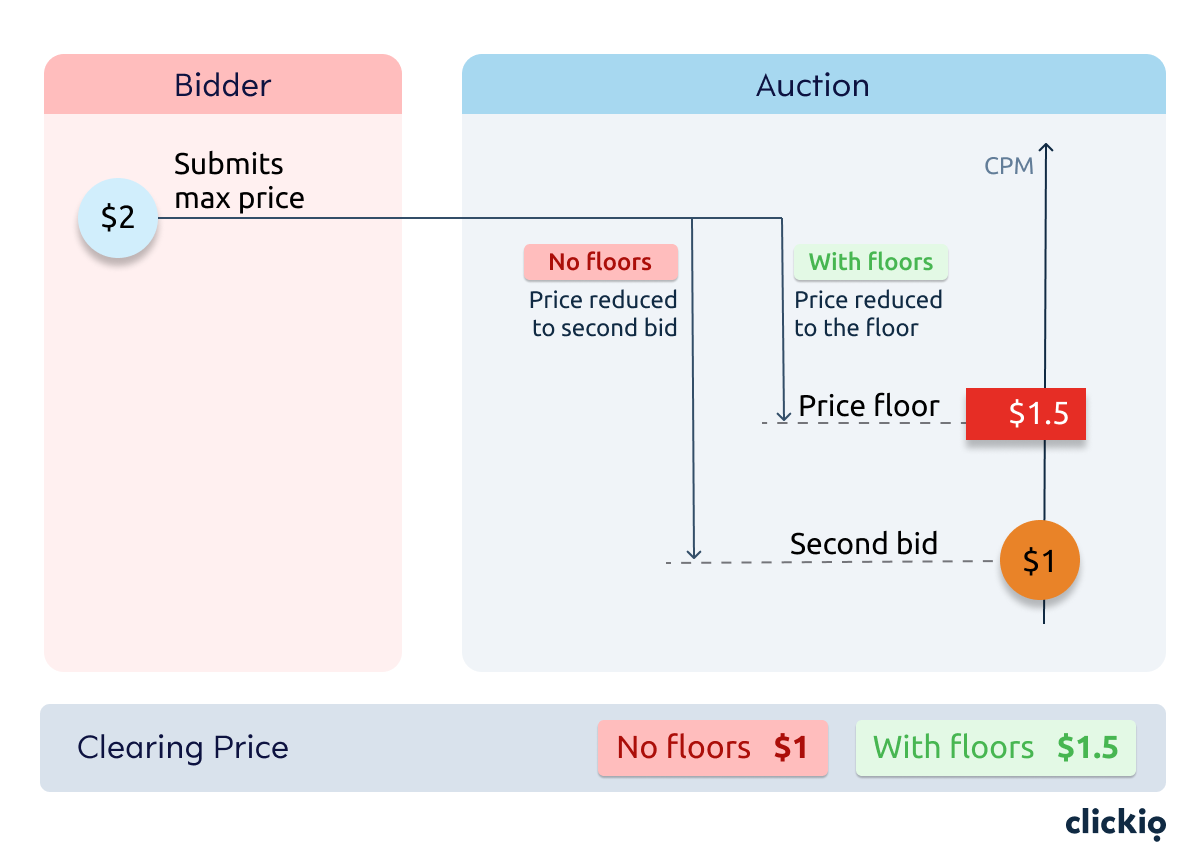

Floors in second price auctions

In the second price auction, the winner pays the price of the second bid or the price floor, whichever is higher. Because the average difference between the first and the second bid could be as high as 50-70%, having a correct floor helps recover some of this revenue.

Floors in first price auctions

In the first price auction, floors do not influence the clearing auction price directly. They can, however, influence the bidding behavior of the buyer.

As we discussed previously, in the first price auction, buyers can no longer send their “maximum possible” price, because the bid is no longer reduced to the second price.

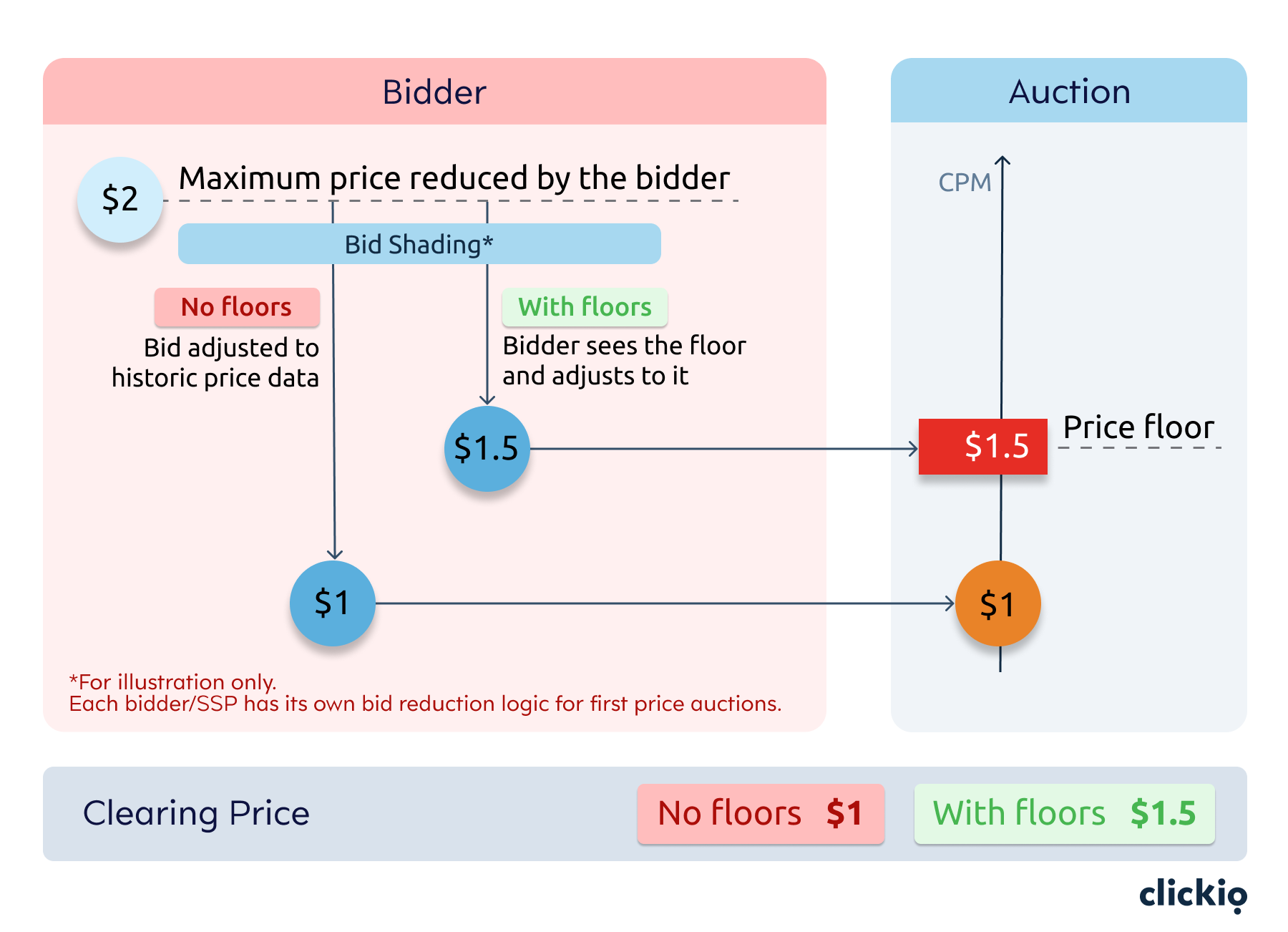

The initial bid needs to be reduced to a level which is lower than the maximum, but would still have a decent probability of winning. Buyers must estimate what the second highest price would be, and adjust their price accordingly. This process and technology behind it is called “bid shading”.

The price floor puts a lower price limit for bid shading algorithms. The effect is similar to the second price auction, but the adjustment happens on the side of the bidder, not in the auction itself. You can learn more in our blog post about bid shading.

In a first-price auction, buyers use a technique called bid shading to reduce the CPM as much as possible without compromising their win rate. Floor rates ensure that buyers don’t reduce their price too low.

—AdExchanger.com

How to prepare pricing strategies for first price world?

Both buyers and sellers will need to adjust their pricing strategies to adapt to the new auction dynamics. “Publishers and app developers will need to rethink how they use price floors and technology partners will need to adjust how they bid for Google Ad Manager Inventory”, Google stated in the announcement.

As the market moves to a first-price model, publishers, such as New York Media, will need to reevaluate how they set the price floors, or minimum sale price, for their inventory. “It is very much going to be a big change for us,” said Fass, who plans to do a lot of testing to see how the publisher should adjust its price floors.

— Digiday.com